Are you thinking about your next tax write off? Your next investment? Or maybe how you can free up some operating cash flow for your Read more Solar panels for commercial

Are you thinking about your next tax write off? Your next investment? Or maybe how you can free up some operating cash flow for your Read more Solar panels for commercial

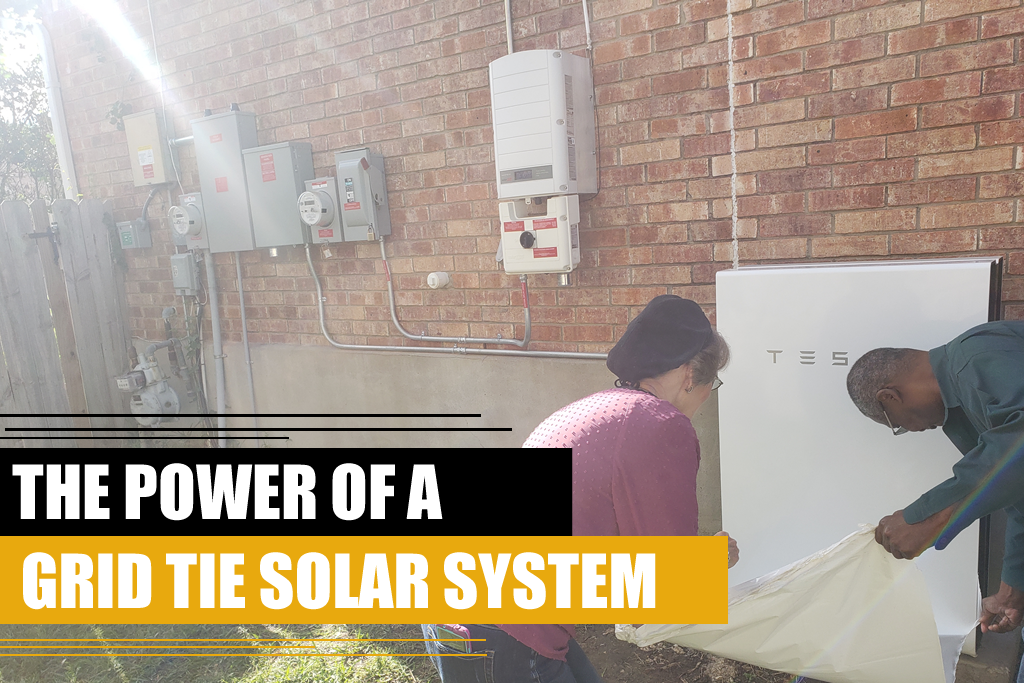

Can your grid-tie solar system include the Tesla Powerwall? Short answer, yes, since Powerwall can become integrated with a new or existing solar system. Remember a Read more The power of a grid tie solar system

There are many home upgrades that can increase your property’s value. One of the major home improvement projects that have gained popularity in the past Read more This is how solar panels boost the value of your property

How can Texans help create a safe and affordable future? Texas is known to be one of the fastest-growing states in the renewable energy sector, Read more Where Can A Solar System For Homes Be